Blog

Impact of granular pricing

Personalized pricing has the potential of doubling revenue over a single optimal price. At the same time adopting a pricing optimization model that optimizes price at an individual level has major risks. After all, how do you get customers to pay a different price for the same product without alienating them?

However, there are cases where customers will tolerate personal pricing when the pricing differences can be explained based on usage, packaging of features and/or service levels. Low introductory prices are well understood and the price increases on renewals from low introductory prices are reasonably well received. Promotional pricing discounts are almost universally used. In addition, customers are fairly tolerant of pricing for different demographic groups such as students, senior citizens, etc

Other factors that influence whether or not personalized pricing is a good fit include the amount of transparency around pricing. Carefully managing different channels as well ensuring that a subscriber is offered only one price at a time is a must.

In particular, magazine subscriptions and other media renewal products is a perfect candidate for personalized pricing.

Potential

The rewards of personal pricing are significant and can include up to 100% in increased revenue.

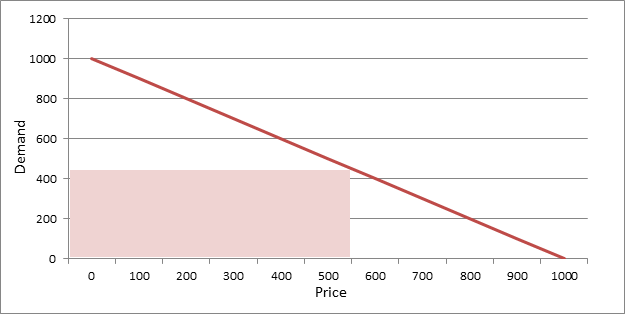

The chart above depicts a simple demand curve. (Most demand curves are much more concave.) The demand for the product is 500 units for the price of $500, is zero at $1000, and increases to 1000 units at $0 price. For this demand curve the price that optimizes the revenue is $500 with a demand of 500, netting total revenue of $250,000. It is easy to see that if we reduce or increase the price the total revenue would decrease. If we were to use the single price of $700, the demand would drop to 300, and the total realized revenue to $210,000.

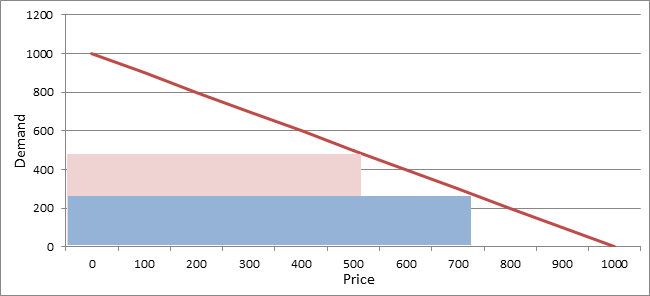

However, if we were able to differentiate between subscribers who are willing to pay $700 and charge them $700 and the remaining subscribers $500, our total revenue would go up to $700*300+$500*200=$310,000. Introducing another price here has helped us increase the revenue by $60,000, approximately an impact of 24%.

Challenges

Meanwhile, adding another price—say $300—would net an additional 200 subscribers. While the average price for the product would drop, but overall we’d have more customers. Good news right?

Yes, but with a caveat. Adding additional rate at $300 for the first time adds additional challenges as our past data would not contain any such renewal prices and hence the behaviour of such subscribers. Such data would have to be gleaned from the discounting the business may have done in the past to win back subscribers who did not renew their subscription at higher prices and then we were able to get them to renew subscription by offering them a lower price. This would also require understanding and modelling the discounting process and negotiating strategy.

Conclusion

When we are able to price for each individual subscriber, we will be able to get the total area under the curve which is $500,000. That is a very significant impact of doubling the total revenue as compared to the single price. With more realistic demand curves the impact is even more significant.

So the question becomes how realistic is it to differentiate the various subscribers and find what they are willing to pay? And then implement it in real life and not create chaos in the subscriber base.

At Apex, we’ve been providing individualized pricing to the The Street for the past two and a half years. The impact? Apex has delivered more than 20% in additional revenue to The Street.